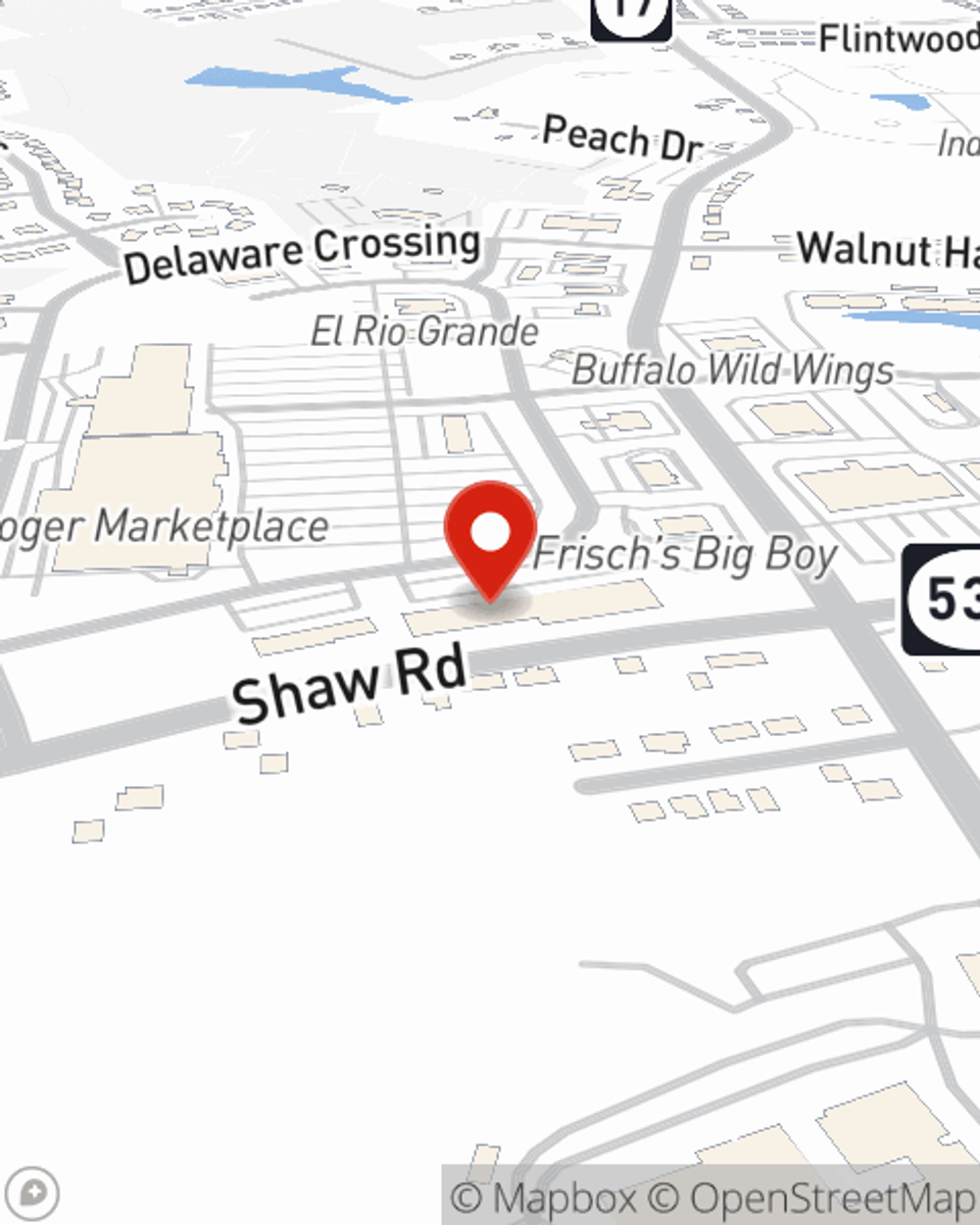

Life Insurance in and around Independence

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Independence

- Florence

- Union

- Taylor Mill

- Covington

- Erlanger

- Fort Mitchell

- Fort Wright

- Walton

- Burlington

- Alexandria

- Dry Ridge

- Boone County

- Kenton County

- Campbell County

- Grant County

- Cincinnati, OH

- Hamilton County, OH

- Ryland Heights

It's Never Too Soon For Life Insurance

People sign up for life insurance for various reasons, but the ultimate goal is normally the same: to protect the financial future for your family after you die.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Their Future Is Safe With State Farm

When it comes to opting for what type of policy is appropriate, State Farm can help. Agent John Hoffman can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include the age you are now, how healthy you are, and sometimes even gender. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your specific situation and needs.

Contact State Farm Agent John Hoffman today to explore how the leading provider of life insurance can ease your worries about the future here in Independence, KY.

Have More Questions About Life Insurance?

Call John at (859) 356-5646 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

John Hoffman

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.